Industry Shifts in Shock Indicators: What the 2026 Price Change Means for Your Supply Chain

And Why ShockWatch-Authorized Impact Indicator 2 Is Becoming the Preferred Choice for Procurement Leaders

The shock indicator industry is entering a transition period that affects procurement teams, packaging engineers, and operations managers across the world. The long-established leading brand in the market recently announced two major changes:

These updates reveal a clear strategic repositioning by the brand. While shipping speed from Mexico may improve due to fewer internal transfers, the overall impact on buyers is more complex. The changes introduce new cost pressures, new taxes and duties, require adjustments in procurement workflows, and alter the value proposition that many businesses have relied on for years.

Because of this, more organizations are actively searching for a stable and authorized alternative—one that offers continuity, predictable pricing, and proven performance. This is where ShockWatch-Authorized Impact Indicator 2 stands out as the reliable successor that maintains quality while reducing unnecessary operational friction.

Switching fulfillment from “Mexico → U.S. HQ → distributors” to “Mexico → distributors” may streamline the brand’s internal logistics, but for global buyers the real picture is different.

Even though the removal of the U.S. consolidation step can shorten lead time, procurement teams are now required to:

Operational velocity improves, yet administrative complexity increases—and these changes require time, staff hours, and procedural updates for organizations across industries.

The upcoming price change does more than raise unit cost. It forces companies to rethink the sustainability of their current monitoring program, especially if they operate large-scale, multi-site, or high-frequency shipping operations.

For organizations managing thousands or tens of thousands of shipments annually, this uplift reshapes the budget outlook for 2026 and beyond.

Even with stable MOQs and no added forecasting difficulty, the combined effect of the supplier’s strategy shift and price increase creates several pain points that directly affect decision makers.

The brand’s new fulfillment model does not provide buyers with new features, better performance, or enhanced service options—yet pricing will still increase by 4.8%.

For executives and procurement managers, paying more for the same device with no measurable improvement raises questions about long-term viability and supplier cost leadership.

Shifting to Mexico-origin shipments means some organizations must review:

These may seem like small changes individually, but together they create new workstreams—and corporate supply chains are already stretched thin.

The leading brand has been a default choice for many years. Teams are accustomed to consistent ordering patterns, established SOPs, and predictable pricing cycles.

With the 2026 price increase and added cross-border complexity, procurement leaders now face a critical question:

Does this supplier still align with our cost, continuity, and efficiency strategies?

Executives and packaging engineers rely on shock indicators not just for damage monitoring, but for:

If the primary supplier increases cost and complexity, organizations naturally look for a solution that preserves performance without introducing operational stress.

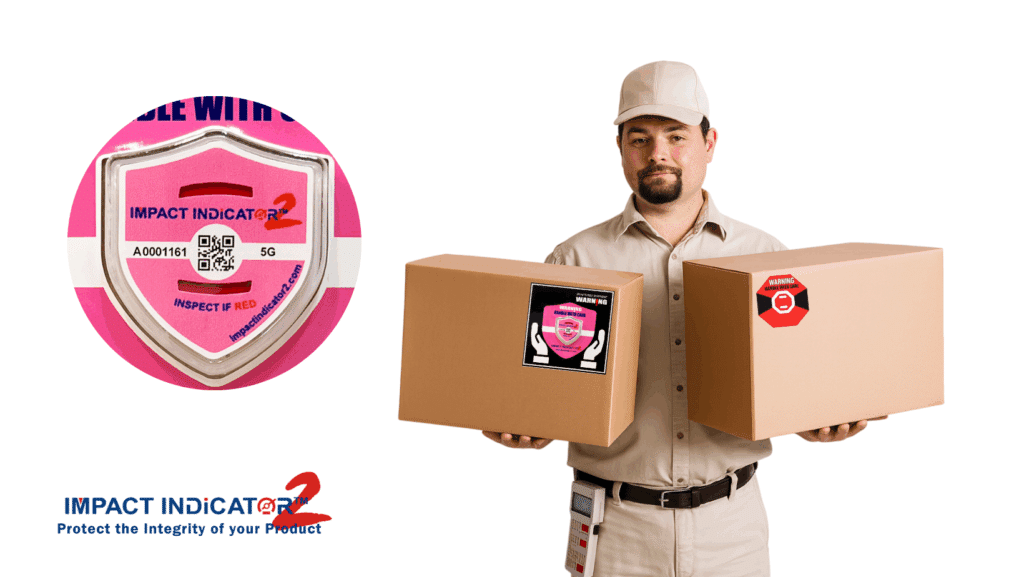

Impact Indicator 2, authorized by ShockWatch, matches the performance standards supply-chain professionals expect—while also offering relief from the challenges introduced by the leading brand’s new strategy.

Impact Indicator 2 provides:

But unlike the leading brand, its cost structure is stable, predictable, and not subject to the 2026 4.8% uplift.

This is critical for companies planning budgets over 12–24-month cycles.

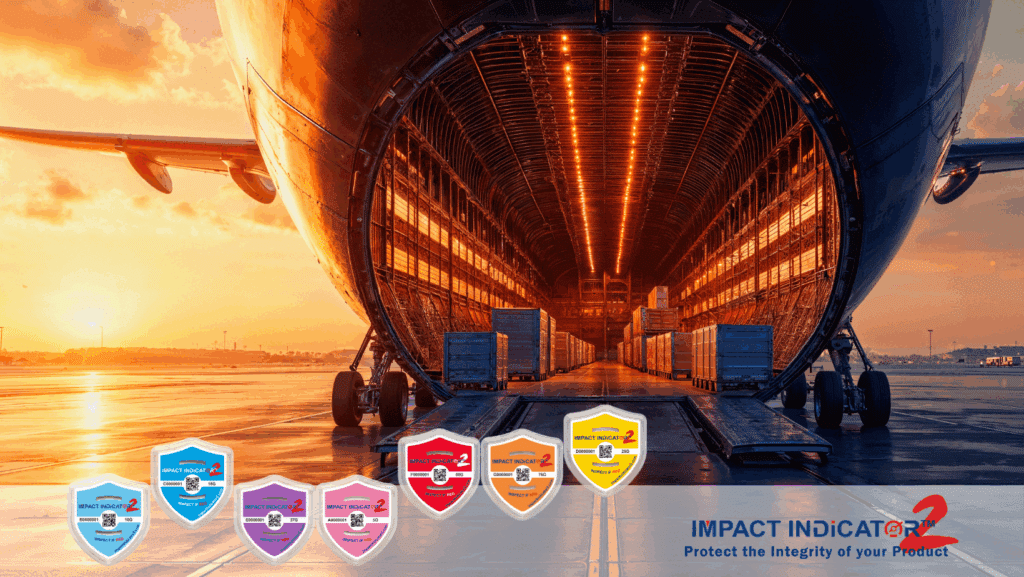

Since Impact Indicator 2 does not require the same Mexico-origin procedural adjustments, buyers enjoy:

Teams can maintain operational continuity without rewriting internal processes.

Engineers appreciate that Impact Indicator 2:

The switch is operationally light, with minimal disruption to line efficiency.

Organizations increasingly prefer supplier diversification as part of ESG, risk-control, and compliance strategies.

Switching to Impact Indicator 2 gives companies:

This strengthens long-term supply-chain resilience.

At the end of the day, your team should be focused on what truly drives value—earning the profits your dealership deserves or keeping your operations running smoothly. You shouldn’t be forced to absorb the turbulence created by a supplier’s internal strategy shift or spend valuable time managing unexpected changes in pricing, workflows, or fulfillment policies.

ShockWatch-Authorized Impact Indicator 2 gives you the stability, predictability, and performance your supply chain requires—so you can stay focused on your core business instead of firefighting procurement disruptions.

Contact us today to transition to Impact Indicator 2 and secure a smoother, more dependable sourcing strategy for 2025 and beyond.